Take the example from no. [ you ll break even on the closing costs in two years, and you don t plan to move for at least five.

Increasing Your Homes Value For Appraisal Refinance Mortgage Home Improvement Loans Second Mortgage

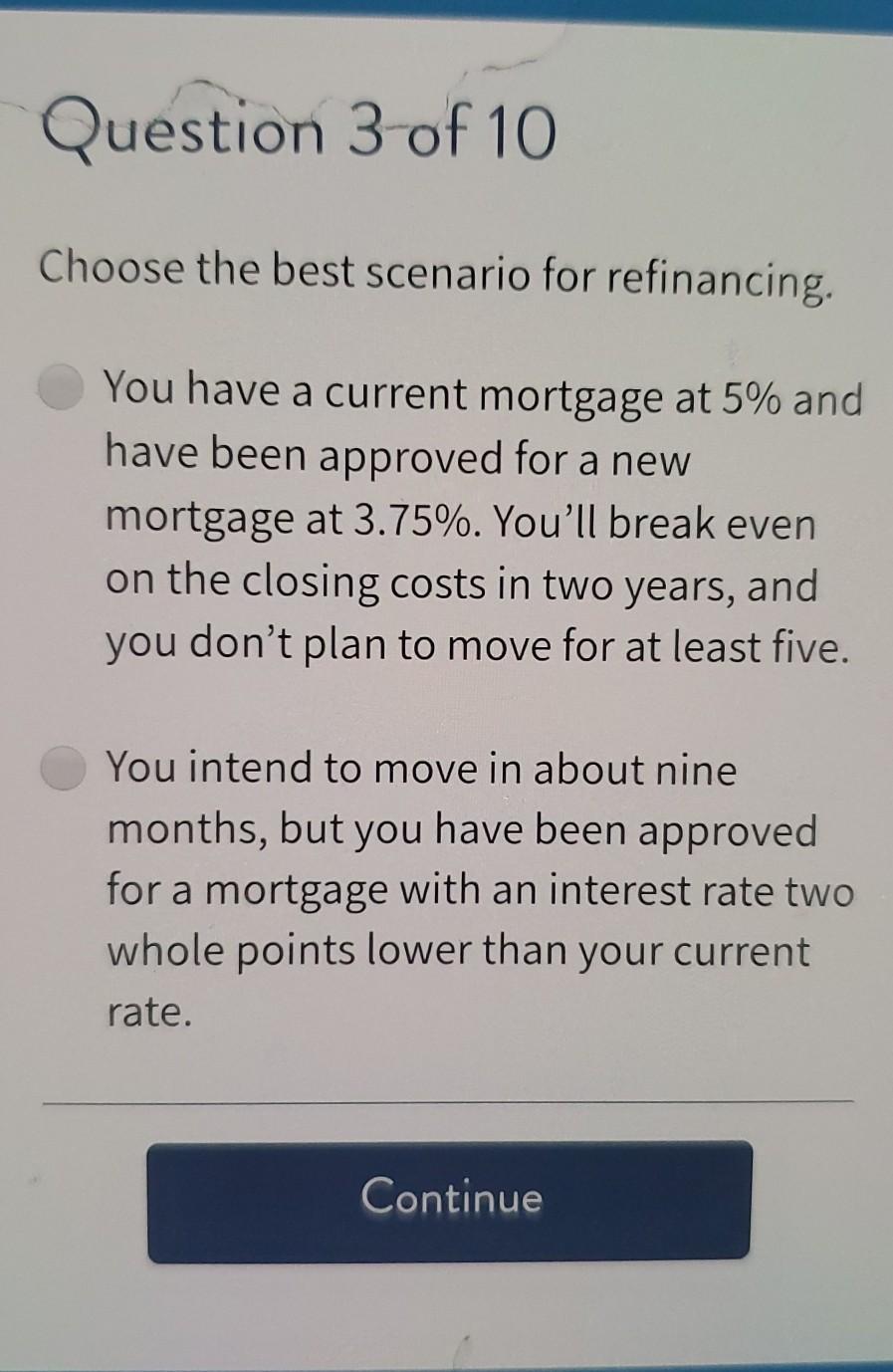

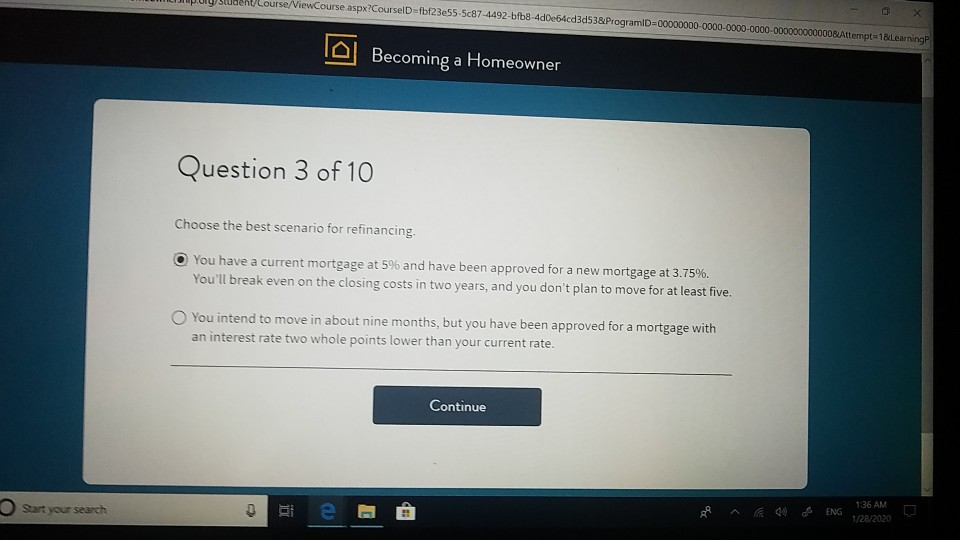

The best scenario for refinancing:

The best scenario for refinancing. If you put that $115 toward principal every month, you’ll pay off your mortgage more than five years early. $152,160.64 (copied from above) loan start date: Are interest rates higher or lower on a mortgages such as a 30 year loan or on a 15 year loan?

You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. Applying for a mortgage refinance in utah is a popular way to reset the clock of your home loan with a smaller interest rate or a shorter term. The goal with refinancing is to get a rate reduction, and it involves getting a new loan with a different (ideally lower) interest rate.

You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. The best scenario for refinancing: The lower interest rate drops your monthly payment from $1,013 to $898, a savings of $115 per month.

Types of loans to calculate include: You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. Generally speaking, if the current rates are lower than when you secured your initial home loan, a new loan could save you a sizable chunk on your monthly payment.

If you bought a home during a time with a higher interest rate than what we’re currently seeing, then this could be a good time for you to refinance. Yet way too many homeowners do nothing when rates drop. An ideal scenario for conventional refinancing is a fico score above 700 and an ltv below 60 percent.

This is because, being aware that you will break even on the closing cost in 2 years which is quite better when compared to no of years to stay (atleast five years) gives the person a competitive advantage. Question 3 of 10 choose the best scenario for refinancing. The best scenarios where you can win in refinancing.

Figure out what your new loan would look like if you refinance. As you can see, refinancing is an important part of managing the investment you call home. Then you can see how your monthly payment will be affected and how much you can expect to pay in closing costs.

Generally, the point of replacing the old mortgage with a new one is to save interest from then on. [ you’ll break even on the closing costs in two years, and you don’t plan to move for at least five. If one of the scenarios outlined above applies to you and you’re considering home refinancing, there are a few steps to take before you begin the process.

How do i know if it’s a good time to refinance? Best case scenario, lenders can close a mortgage refinance within two to three weeks if the loan application and approval goes smoothly, says greg mcbride, chief financial analyst at bankrate. You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%.

You’ll break even on the closing costs in two years, and you don’t plan to move for at least five. Choose the best scenario for refinancing. For example, if interest rates have fallen since you first took out your mortgage,.

Choose the best scenario for refinancing the best scenario for refinancing: [ you’ll break even on the closing costs in two years, and you don’t plan to move for at least five. So many that researchers are trying to figure out why.

You’ll break even on the closing costs in two years, and you don’t plan to move for at least five. You want to lower your interest rate. Interest rate on new loan:

You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. Student loan refinancing on the other hand can be done with multiple loans (federal or private student loans), and it can also be done with one loan. Borrowers can qualify for refinancing with ltvs of 80 percent or lower.

The best scenario for refinancing is: Refinancing from 4.5 percent to 3.5 percent on a $200,000 loan. For this example, assume the following:

You'll break even on the closing costs in two years, and you don't plan to move for at least five. Your financial situation will dictate what type of refinancing might make sense. Overall interest rates went down.

You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. If you are refinancing with the goal of lowering your interest rate, many industry experts believe you should not refinance unless the interest rate is at least 2% below your current mortgage rate. Many homeowners in states like utah and arizona like.

You’ll break even on the closing costs in two years, and you don’t plan to move for at least five. Choose the best scenario for refinancing the best scenario for refinancing: Choose the best scenario for refinancing.

Ini Adalah Alamat Toko Penjualan Catur Di Surabaya Menyediakan 1 Papan Catur Lipat 2 Bidak Catur Kayu 3 Bu Home Loans Minnesota Home Real Estate Business

Pin On Of Independent Means Blog Women And Money Updates

So In Each And Every Scenario An Unsecured Loan For House Improvement Is Really A More Disciplined And Che Refinance Mortgage Home Improvement Loans Home Loans

3 Simple Mortgage Tricks Can Save You Over 5000year - Growthrapidly Refinancing Mortgage Mortgage Tips Mortgage

Current Interest Only Mortgage Rates Freeandclear Interest Only Mortgage Mortgage Rates Refinancing Mortgage

Conventional Loan - Co-branded Mortgage Marketing Mortgage Construction Loans

Seller Concessions Other Peoples Money Concession Home Loans

Buying A 2 Bhk In Goregaon Can Be A Fulfilling Dreams Home Buying Real Estate Buying First Home

The Mortgages Calculator Is The Feature Which Is Providing By Us The Mortgages Payment C Mortgage Refinance Calculator Home Improvement Loans Reverse Mortgage

Conforming Loan Limit Calculator Freeandclear Best Home Loans Mortgage Help Best Mortgage Lenders

So In Each And Every Scenario An Unsecured Loan For House Improvement Is Really A More Disciplined And Less Home Equity Loan Home Improvement Loans Home Equity

A Scenario Car Loan Without Credit Car Loans Private Finance Loan

The Best And Worst Ways To Use Home Equity According To Experts Huffpost Refinance Mortgage Mortgage Amortization Paying Off Mortgage Faster

Louisville Kentucky Va Home Loan Mortgage Lender Louisville Kentucky Mortgage Lender For Fha Va Va Mortgage Loans Refinance Loans Mortgage Lenders

Solved Vuiusuara Lourseviewcourse Cheggcom

Why You Should Opt For Commercial Equipment Loans Business Loans Refinance Mortgage Mortgage Tips

Key And House - Stock Photo Ad House Key Photo Stock Ad Sleutel

Solved Question 3 Of 10 Choose The Best Scenario For Cheggcom

Make Your Overdraft Work For You Mortgage Interest Rates Refinance Loans Mortgage Interest